Finally, a Website that explains Medicare in a simple and easy to understand way!

Welcome to The Grace Agency's website! We are a family owned and operated insurance agency committed to serving medicare eligible beneficiaries with honesty, integrity and respect! Our agency’s computer software is a one stop shop for your Medicare Advantage, Medicare Supplemental Plans and Medicare Part D Plans. It allows us TO SEE ALL OF THE PLANS YOUR DOCTORS ACCEPT WITH THE MOST BENEFITS!

Our highly trained team of licensed agents will help you shop and compare plans as well as assist you in the enrollment application. The best part is WE DO NOT CHARGE FOR THESE SERVICES! Our agents are licensed and contracted with most major carriers across America, and are paid by the plan’s carrier upon enrollment. When we shop plans for you, we use extreme care and consideration for your unique needs and budget.

GETTING STARTED IS EASY! Choose an agent licensed in your state and then CLICK SEE MEDICARE PLANS beneath their photo. Put in your zip code to see all of the plans offered in your area and you can either choose to enroll right there or work directly with one of our trusted agents. An agent can easily complete the application and enrollment for you or walk you through it step by step at no cost to you, it really is that simple! Our agents also look over your profile to see if you qualify for any extra benefits from both the State and Federal Government.

We love what we do and as a rule we treat our clients the way we would want to be treated. Other agent relationships stop after the enrollment. At The Grace Agency, our mission is to become your trusted life and health insurance resource for life.

Don't miss the tool bar at the top right hand corner of our website! Click the 3 dashes to access important information, forms and applications.

Scroll down to choose your agent!

PLEASE READ BEFORE SELECTING YOUR MEDICARE PLAN:

After clicking on the MEDICARE Plans link under the Agent of your choice, you will then be prompted to enter your zip code and county. FOUR TABS WILL APPEAR at the top of your screen, to select the type of plan you want to enroll in.

The second tab from the left labeled "Medicare Advantage Prescription Drug Plans" is for Medicare beneficiaries who do WANT PRESCRIPTION DRUG COVERAGE with their Medicare Plan.

The tab third from the left labeled “Medicare Advantage Plans” are plans designed for Veterans only and DO NOT come with prescription drug coverage, as Veterans often receive their prescription drug coverage from the VA.

Agent Robert Potts

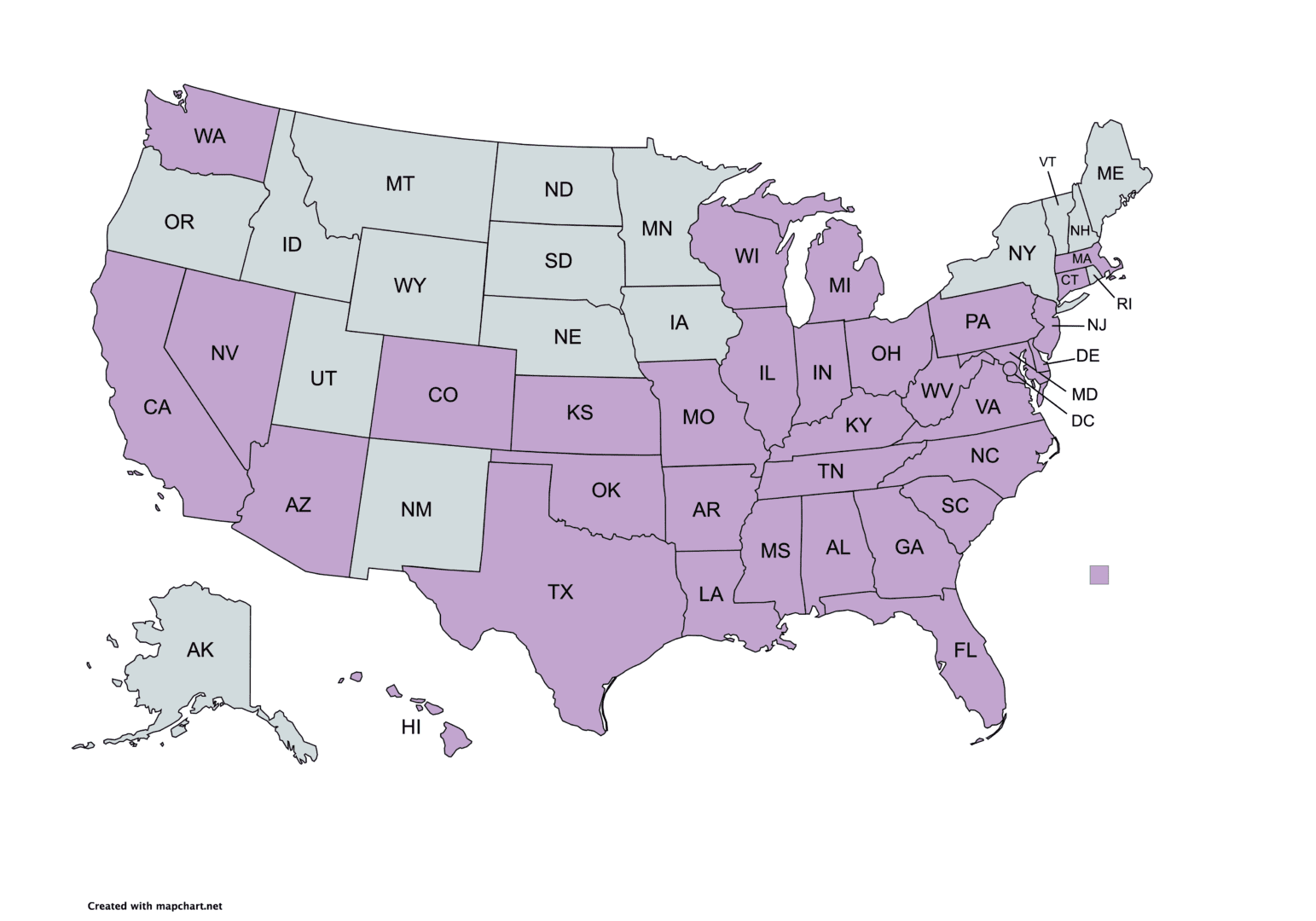

See Medicare PlansAL AR AZ CA CO CT FL GA HI IL IN KS KY LA MA MD MI MS MO NC NJ NV OH OK PA RI SC TN TX VA WA WI WV

If you do not see your state listed please call (800) 923-7074 as the website is in the process of daily updates.

Your Medicare Options

When you become eligible for Medicare, you have 3 options to choose from and here they are:

OPTION 1 - ORIGINAL MEDICARE:

This is your red white and blue Medicare Card alone that you receive in the mail from the Federal Government when you either first become eligible for Medicare at 65 years old or become eligible after being on Medicare Disability for a minimum of 24 months. Original Medicare only covers 80% of your Medicare Healthcare costs leaving you paying the other 20% that medicare does not cover often referred to as “the gap” in coverage. With just your Medicare Card alone, you will have to pay the Medicare Part A (Hospital Deductible) of $1,684 for days 1 thru 60, days 61- 90 you pay a $419 per day copay. Days 91-150 you pay a $838 per day, after day 150 you pay ALL HOSPITAL COSTS and the $257 Part B Deductible one-time per year when you go to see a Medicare Doctor or Specialist. A plan above helps you avoid these costs! In 2025 the Part B Premium (the cost the Federal Government charges you for your Medicare Card) is $185.00 (unless you qualify for Medicaid) See income limits by state chart or we will be happy to see if you qualify. If you have a higher income, you may have to pay more than the $185.00 per month for your Part B premium and we can tell you how much that will be if you call us. What’s most important to keep in mind is that there is no cap or limit on the 20% that the Medicare Card does not cover, which could potentially lead to some higher healthcare cost for you with just a Medicare Card alone. This is why people choose a plan offering additional coverage. You can choose either a Medicare Advantage Prescription Drug Plan (Option 3 below) or a Medicare Supplemental Plan together with a Stand-Alone Prescription Drug Plan (Option 2 below). Choosing a plan offering additional coverage can ensure Medicare healthcare benefits are covered 100%.

OPTION 2 - SUPPLEMENTAL PLANS - (MEDIGAP PLANS):

Supplemental plans are popular for people who do not want to be limited to a network of doctors or their doctor is not in any network. On a Supplemental plan you can see any doctor who accepts Medicare. A Supplement or MEDI-GAP plan ONLY Covers the 20% gap in coverage that Original Medicare does not cover. Some Supplemental plans do not pay the $1,684.00 Part A Deductible and NONE pay your $257.00 Part B Deductible for 2025.

Supplemental plans come with no Prescription Drug Coverage so you must buy a Stand-Alone Prescription Drug plan (PDP) to avoid a 1% late enrollment penalty. Supplemental Plans also charge a monthly premium that can and most of the time will increase yearly so it is important to compare rates in your area annually.

Supplemental plans can raise your monthly premium at least once a year and in some states are allowed to increase your premium twice in one year so please pay attention to this. If you choose a Supplemental Plan you can expect to have a monthly plan premium for the Supplemental Plan in addition to a monthly premium for your stand alone prescription drug plan (PDP) and Medicare Part B premium of $185.00.

Within the first six months after turning 65, Medicare eligible beneficiaries can enroll into a Supplemental Plan without having to answer any medical underwriting questions. If you switch to a Supplemental Plan after your initial open enrollment period, you could be subjected to higher premiums or possibly denied access based on any pre-existing conditions.

OPTION 3 - MEDICARE ADVANTAGE PRESCRIPTION DRUG PLANS (MAPD PLANS):

These plans are popular for people who do not want to pay additional monthly plan premiums on top of their required $185.00 Medicare Part B Premium. A Medicare Advantage Prescription Drug Plan pays for the 20% gap in coverage your Original Medicare card does not cover and includes a Prescription Drug Plan with most MAPD plans having $0 or low monthly premiums.

Most Medicare Advantage Prescription Drug Plans include additional benefits such as Dental, Vision, Hearing coverage AND a Fitness Club Membership at no additional cost. These plans often have no deductible for both Medicare Part A (Hospital) and Medicare Part B (Doctor and Specialist) coverage as well as for their Tier 1, 2 and 3 prescription drugs.

NOTE: It is illegal for telemarketers to call Medicare Beneficiaries without their permission offering Medicare Advantage Plans, because these plans are subsidized by the Federal Government. Telemarketers often call from fake phone numbers and hang-up if you ask for their phone number. These telemarketers know they can face large fines and the agent they transfer your call to can lose their insurance license if caught! We advise that beneficiaries never give out their Medicare card number to a telemarketer who has called you unsolicited.

Many people on Employer Group Plans, get on Medicare as soon as they’re eligible to avoid having a high medical deductible on their group plan, saving them thousands of dollars a year in healthcare costs!

IMPORTANT: Call us today to see if you qualify for a Low Income Subsidy (LIS) or “EXTRA HELP” which can lower your Prescription drug copays!

We will also check to see if you qualify for QMB or SLMB (Medicaid) which can pay for your monthly Part B Premium ($185.00).